Dear Reader,

As 2021 is already shaping up to be a volatile year in the markets, I have outlined a simple strategy below that can help boost your wealth as you take advantage of the inevitable ups and downs.

Dollar-cost-averaging is a simple technique that involves investing a fixed amount of money at regular intervals (monthly, bi-weekly, etc.) over a long period of time. Whether the market is up or down, you simply contribute the same amount. This can be set up automatically with a fixed amount of your choosing on a start date of your choosing.

The Power of Dollar-Cost Averaging: How it works

Dollar-cost averaging is a simple technique that involves investing a fixed amount of money at regular intervals over a long period of time. The number of shares or units purchased each month varies depending on the share price of the investment at the time of the purchase.

When the share price rises, your money will buy fewer shares per dollar invested. When the share price falls, your money will get you more shares.

Over time, the average cost per share should be more favorable than if you were to time the market.

Here is an example:

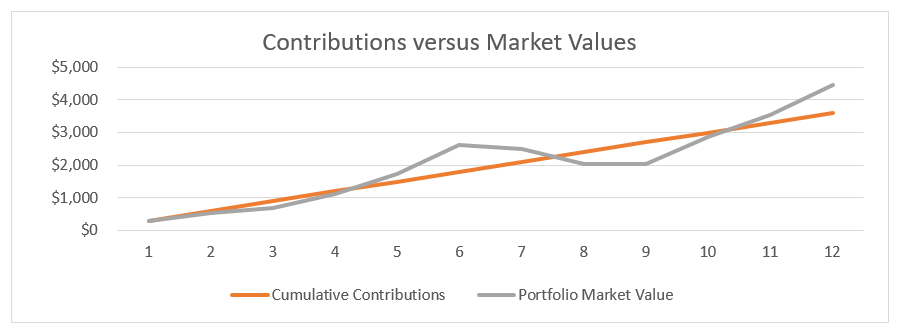

Each month, an investor decides to contribute $300 to their investment portfolio. She intends to make this monthly contribution regardless of market conditions. As you can see from the table below, the share/unit price fluctuates somewhat dramatically, but she remains unfazed – contributing the $300 like clockwork each month.

So how did she do?

At the time of her first investment, the share/unit price was $10.00. Through the year, this investment oscillated both up and down – the end result being that the share/unit price was still $10.00 after 12 months.

Normally a share/unit price that begins the year at $10.00 and ends the year at $10.00 would realize a return of 0%.

But since the $300 contributions occurred at varying share/unit prices throughout the year, this investor was able to reap a significant gain ($4,468.42 from $3,600.00 in contributions in 1 year !).

How did this happen?

Here is another look at what transpired in graphical format:

The Benefits of Dollar-Cost-Averaging

1. Risk reduction

Dollar-cost-averaging reduces investment risk, and capital is preserved to avoid a market crash. It preserves money, which provides liquidity and flexibility in managing an investment portfolio.

Some downturns are prolonged, further diminishing portfolio net worth. Using dollar-cost-averaging ensures minimum loss and possibly higher returns. Dollar-cost-averaging can reduce feelings of regret through its provision of short-term, downside protection against a swift deterioration in a security price.

A declining market is often viewed as a buying opportunity; hence, dollar-cost-averaging can significantly boost long-term portfolio return potential when the market starts to rise.

2. Lower cost

Buying market securities when prices are declining ensures that an investor earns higher returns. Using the dollar-cost-averaging strategy ensures that you buy more securities than you would if you had purchased when prices were high.

3. Ride out market downturns

Using the dollar-cost-averaging strategy by investing periodic smaller amounts in declining markets assists in riding out market downturns. A portfolio using dollar-cost-averaging can keep a healthy balance and leave the upside potential to increase portfolio value in the long term.

4. Disciplined saving

The strategy of adding money regularly to an investment account allows disciplined saving, as the portfolio balance increases even when its present assets are depreciating. However, a prolonged market decline can be detrimental to the portfolio. This strategy is reserved for longer-term investors.

5. Prevents poor timing

Market-timing is not a pure science that many investors, even professional ones, master. Investing at the wrong time can be risky, which can adversely affect a portfolio’s long-term value significantly. It is impossible to predict market swings; hence, the dollar-cost-averaging strategy will provide a smoothening of the cost of purchase, which can benefit the investor.

6. Manages emotional investing

The phenomena of emotional investing brought about by various factors – such as the endowment effect and loss aversion – is not unusual in behavioral theory. The use of dollar-cost-averaging eliminates or reduces emotional investing.

A disciplined buying strategy through dollar-cost-averaging makes the investor focus their energy on the task at hand (aiming to reach your financial objectives) and eliminates news and information hype from various media about the stock market’s short-term performance and direction.

This strategy aims to remove market-timing and intuition from your investing decisions and is best-suited for portfolios with long-term time horizons.

If you are interested in taking advantage of this strategy or are interested in increasing the current contributions to your existing strategy, please let us know.

The take-home here is to ensure you have a framework for long-term investing, and to ensure your emotions (excitement when markets are up, fear when markets are down) don’t cloud your judgment in sticking to that framework.

If you have any questions about your financial plan, would like our opinion on what this current financial landscape means for long-term investors, or would like a refresh on the framework we have in place for times like these, please never hesitate to reach out.

Be well and be safe.

.png)

Comments